Business Start up Credit

Business Start up Credit

On the previous post I mentioned how you can start building business credit right away by having your everyday expenses like web hosting, phone services and printing reported on your profile. If the companies you’re doing business with are not reporting your payment history you can use a business credit builder product at DNB that will get the job done.

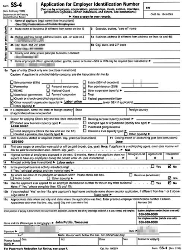

You can also start corporate credit accounts with companies like Verizon, Quill, Accurate Office Supply, Best Buy, Fed Ex and many others. You will need to provide your EIN number when you open an account and some companies will request your Dun & Bradstreet number. Remember, not all companies that you start business credit with will report your payment history.

Also, each company has its own credit approval guidelines and minimum requirements for business start up credit. For example, Accurate Office Supply offers a net 30 account with no personal guarantee but requires your business to have a minimum of three trade references and one bank reference.

So if your goal is building a strong business credit file then you will either need to select companies that report to the business credit bureaus or use the dun & bradstreet credit builder product to have your trade references added yourself.

You can also take advantage of companies that provide you a business credit supplier directory like the Business Credit Insiders Circle.

Business Credit Blog » Business Credit » Start Business Credit – start up credit for small business

Start up Business Credit Cards

While trade credit with companies like Quill and Fed Ex can help your business fund its short term needs cash credit is much more preferable. The mistake that most business owners make is applying for a business credit card that requires a personal credit check as well as a personal guarantee.

These types of cards are a glorified version of a personal credit card because the charges and debt your business incurs all report on your personal credit reports. Furthermore if you default on any outstanding debt incurred on the card then you are personally liable for that debt.

So you’re probably wondering how a start up company like yours can obtain a business credit card with no personal credit check or personal guarantee. For starters I suggest a secured business credit card for establishing business credit. After several months of solid payment history you can request an unsecured credit line increase.

In addition you may want to consider a business debit card from the bank that services your business checking account. Even though this doesn’t start corporate credit for your company it does help establish bank credit.

You should always take advantage of these types of products offered at your bank. Some banks like Comerica, Key Bank and Associated Bank have its business credit card issued through Élan Financial Services. Élan’s underwriting guidelines for business credit cards require a personal credit check for approval but your company’s revolving debt and payment experience do not report to your personal credit reports. A big plus for your personal debt to credit limit ratios!

As you can see even start ups can start building business credit with everyday expenses, corporate credit accounts, a secured business credit card, a business debit card and business credit cards.

To your business credit success!

Business Credit Resources

» Business Credit Seminar

» Business Credit Insiders Circle

» Business Credit Blog

To access business credit insider secrets, premium vendors, leasing companies, business credit cards, and lenders that report to all the major business credit bureaus become a member of my Business Credit Insider’s Circle. Submit your name and email below for details and receive a free audio seminar ($597 value) =>

Marco Carbajo is a business credit specialist, author, speaker, and founder of the Business Credit Insider’s Circle. He is a weekly columnist for Dun & Bradstreet Small Business Solutions, a business credit blogger for All Business & American Express Small Business and author of “Eight Steps to Ultimate Business Credit” and “How to Build Business Credit with No Personal Guarantee.” His articles and blogs have also been featured in Business Week, The Washington Post, The San Francisco Tribune, Scotsman Guide, Alltop, Entrepreneur Connect, and Active Rain.

Marco Carbajo is a business credit expert, author, speaker, and founder of the Business Credit Insiders Circle. He is a

Marco Carbajo is a business credit expert, author, speaker, and founder of the Business Credit Insiders Circle. He is a