What is Dun and Bradstreet?

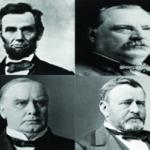

Do you know what Abraham Lincoln, Ulysses S. Grant, Grover Cleveland, and William McKinley all have in common other than being U.S. Presidents?

They all worked as credit reporters at The Mercantile Agency, a predecessor to Dun and Bradstreet.

The history behind the business credit reporting giant, Dun and Bradstreet, is fascinating stemming all the way back to an American businessman and entrepreneur known as Lewis Tappan.

Click to continue …