Business Federal Tax ID

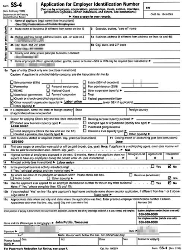

A business Federal Tax ID number (also called an EIN number) is mandatory, because without one, your corporation will be useless. Your Tax ID number will be the number that identifies your business and information. It’s just like how your Social Security number will identify who you are for your personal credit.

Once you have incorporated your business then you’re ready to apply for an EIN.

If you already have a corporation or LLC but do not have a Federal Tax ID number than you will need to apply for one.

For more information be sure to check out the FAQ section on Employer ID Numbers.

If you have had a corporation for some time but never have obtained a tax ID number don’t worry. Tax ID numbers are not generated in a numerical fashion and there is no way for a lender to determine when your tax ID was obtained and compare it to the start of your business.

This is also important to know for shelf corporations if you are planning on using one. After you have obtained your tax ID number for business you’ll also be ready to open a small business bank account.

If you’re serious about building business credit without a personal guarantee then you will have to complete these two steps before you can move forward:

- Incorporate your business

- Obtain a Federal Tax ID#

What type of business structure do you have?

Ready to start building business credit for your corporation? Become a member of my Business Credit Insiders Circle and gain access to a proven step-by-step business credit building system? A system that provides you access to premium vendors, business credit cards, funding sources and lenders that report to all the major business credit bureaus. Submit your name and email below for details and receive a free audio seminar ($597 value) =>

To Your Success In Business and in Life!

Did This Blog Help You? If so, I would greatly appreciate if you like and shared this on Facebook and Twitter.

About the author

Marco Carbajo is a business credit expert, author, speaker, and founder of the Business Credit Insiders Circle. He is a business credit blogger for Dun and Bradstreet Credibility Corp, the SBA.gov Community, About.com and All Business.com. His articles and blog; Business Credit Blogger.com, have been featured in ‘Fox Small Business’,’American Express Small Business’, ‘Business Week’, ‘The Washington Post’, ‘The New York Times’, ‘The San Francisco Tribune’,‘Alltop’, and ‘Entrepreneur Connect’.

Marco Carbajo is a business credit expert, author, speaker, and founder of the Business Credit Insiders Circle. He is a business credit blogger for Dun and Bradstreet Credibility Corp, the SBA.gov Community, About.com and All Business.com. His articles and blog; Business Credit Blogger.com, have been featured in ‘Fox Small Business’,’American Express Small Business’, ‘Business Week’, ‘The Washington Post’, ‘The New York Times’, ‘The San Francisco Tribune’,‘Alltop’, and ‘Entrepreneur Connect’.

Thank you very much for the positive feedback. I love what I do and enjoy providing as much value as I can to my readers. All the best to you and feel free to subscribe to my feed. 🙂

Hi Kris,

You can obtain an EIN as a sole proprietor but keep in mind that as a sole proprietor you can have only one EIN, regardless of the number or types of businesses you operate.

Best of success! 🙂

Thank you for the feedback and glad to have you as a reader. 🙂

Right on Tax Guy! Thank you for the input! 🙂

Thank you for the feedback. Glad to hear that you are finding the information helpful. 🙂

Hi Terrence,

Thanks for the feedback and congrats on owning your own DJ business. You should definitely consider incorporating your business because as a sole proprietorship all of your personal credit and personal assets are at risk.

Once you select the right business entity then it’s time to start building business credit.

Go for it!

Marco 🙂