Business Credit Ratings

There’s been quite a stir on the integration of FICO® 08 which is the credit scoring system used by the majority of lenders to determine a consumer’s credit worthiness. Similar to your personal credit ratings, businesses and corporations also have business credit ratings that potential lenders use to determine its credit worthiness.

Unlike a personal credit rating, there is no designated standard for determining the credit worthiness of businesses. However, the main tool used to determine and establish company credit ratings is D&B’s PAYDEX system.

Where a personal FICO® score is based only on credit history that includes information on how much a person borrows and how well they repay loans, a credit rating for a business takes into consideration company size as determined by assets and number of employees.

Where personal credit ratings are based on financial information provided by credit card companies, retail establishments, and financial institutions, a business credit report and rating is determined by information supplied by the business owner and gathered from vendors, suppliers, and other trade accounts.

For this reason, potential lenders may be different from one another in their evaluation of a business’ credit history by emphasizing certain qualifications more than others.

Like most industries, there is a specialized language involved with business credit reports and ratings.

The following is a list of some of the most common concepts and terms as well as their definitions:

Average High Credit / Highest Credit

In order to put a business’s credit in perspective, these are based on the total amount of credit owed as compared to the industry as a whole.

Business in Good Standing

Includes any problems with the business overall.

Commercial Credit Score

A D&B prediction regarding the chances of an account becoming severely delinquent within one year.

Comprehensive Report

This is a combination of several D&B business credit reports that paints a more complete picture of the company’s credit history. It includes the results of the PAYDEX analysis, a company’s credit score and Financial Stress class, as well as any public filings or liens, the business’s history and operations (including when it filed for incorporation, annual financial statements, facilities, affiliations, and number of employees).

Credit Score Class

This is part of the D&B assessment that gauges payment habits to determine how likely it is that a potential account will be delinquent in the next 12 months. The scoring can range from 1 to 5 with 1 being the score assigned for the lowest risk and 5 for the highest.

Financial Stress Score

This is part of the D&B assessment that analyzes the Financial Stress that a business is experiencing in order to predict how likely it is that a business will fail in the next 12 months.

PAYDEX

This is D&B’s primary assessment that analyzes how likely it is that a company will make its future payments on time. An 80 paydex score for a business can be compared to having a 720 personal credit score.

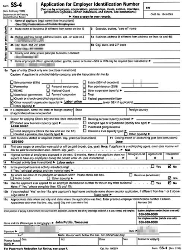

Sample business credit reports:

Dun & Bradstreet business information report sample

Dun & Bradstreet enhanced comprehensive report sample

Dun & Bradstreet Credit eValuator Plus Report sample

Corporate Experian Business Credit Score Report sample

Small Business Equifax Commercial Credit Report sample

To order business credit reports:

Equifax Small Business Enterprise

Experian SmartBusinessReportsTM

Every business will at one point require an influx of cash in order to cover operating expenses, expansion costs, legal fees, inventory or a range of other items the business may require in order to operate. The worst mistake you can make is seeking funding when your business needs it most. Lenders extend cash credit lines to businesses that don’t need the capital and have strong business credit ratings. Start digging your well before your business gets thirsty!

Are you ready to start building your business ratings? Become a member of my Business Credit Insiders Circle and gain access to a proven step by step business credit building system. A system that provides you access to premium vendors, business credit cards, funding sources and lenders that report to all the major business credit bureaus. Submit your name and email below for details and receive a free audio seminar ($597 value) =>

About the Author

Marco Carbajo is a business credit expert, author, speaker, and founder of the Business Credit Insiders Circle. A business credit solutions membership helping business owners build small business credit. He is a weekly columnist for Dun & Bradstreet Small Business Solutions, a business credit blogger for All Business & American Express Small Business and author of “Eight Steps to Ultimate Business Credit” and “How to Build Business Credit with No Personal Guarantee.” His articles and blogs have also been featured in Business Week, The Washington Post, The San Francisco Tribune, Scotsman Guide, Alltop, Entrepreneur Connect, and Active Rain.

Marco Carbajo is a business credit expert, author, speaker, and founder of the Business Credit Insiders Circle. A business credit solutions membership helping business owners build small business credit. He is a weekly columnist for Dun & Bradstreet Small Business Solutions, a business credit blogger for All Business & American Express Small Business and author of “Eight Steps to Ultimate Business Credit” and “How to Build Business Credit with No Personal Guarantee.” His articles and blogs have also been featured in Business Week, The Washington Post, The San Francisco Tribune, Scotsman Guide, Alltop, Entrepreneur Connect, and Active Rain.

Marco Carbajo is a business credit expert, author, speaker, and founder of the Business Credit Insiders Circle. He is a

Marco Carbajo is a business credit expert, author, speaker, and founder of the Business Credit Insiders Circle. He is a  I was excited to write this particular post because there is such a tremendous lack of awareness in the entrepreneur and small business community surrounding the business credit industry.

I was excited to write this particular post because there is such a tremendous lack of awareness in the entrepreneur and small business community surrounding the business credit industry.

In the past during good economic times you may have become accustom to using personal credit cards to finance purchases, equipment, and even payments to suppliers or vendors when starting and operating your business.

In the past during good economic times you may have become accustom to using personal credit cards to finance purchases, equipment, and even payments to suppliers or vendors when starting and operating your business.