Please Log in to view this content.

How To Build Business Credit With Bad Personal Credit

After presenting to REIA of Macomb last week it was clear to me that building business credit was a HOT topic for real estate investors. It was interesting to find that small business owners and real estate investors have similiar questions when it comes to business credit.

After presenting to REIA of Macomb last week it was clear to me that building business credit was a HOT topic for real estate investors. It was interesting to find that small business owners and real estate investors have similiar questions when it comes to business credit.

As a result of the economic downturn many find themselves being faced with less than perfect credit. While credit repair companies are springing up all over the country there are few like United Credit that can truly deliver.

But in the meantime can you start building business credit with bad personal credit?

Absolutely!

There are vendors, suppliers, leasing companies, and even cash credit issuers that will extend credit to your business solely based on your businesses credit rating. In order for you to obtain cash credit without a personal guarantee first requires you to start establishing strong business credit with vendors & suppliers.

The key is identifying which vendors & suppliers offer the following:

-

Credit with no personal credit checks

-

Credit with no personal guarantee

-

Credit for start ups (great for new entities)

-

Monthly payment reporting to business credit bureaus

If this part leaves you scratching your head don’t worry we have all this work already done for you if you’re interested. As long as you understand the fact that cash credit without a personal guarantee can only happen once you have established a strong business credit profile.

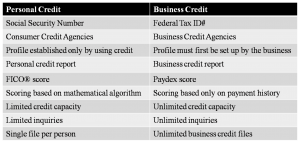

Here’s a quick comparison on personal credit vs. business credit.

As you can see there are HUGE differences and the one in particular that should get you really excited is the unlimited amount of business credit files you can establish!

For a complete list of our preferred business credit sources join my business credit community today!

Remember – Abundance is not something we acquire. It is something we tune into. ~ Wayne Dyer

To Your Success!

Marco Carbajo

About the Author

Marco Carbajo is a business credit specialist, author, speaker, and founder of http://www.startbusinesscredit.com . Want to learn more about how to build business credit and obtain unlimited financing for your business? Claim Marco’s popular FREE business credit seminar ($597 Value), available by simply submitting your email below =>

Start Business Credit: Business Line of Credit

A business line of credit is a financing tool offered by most business banks. In a nutshell it’s a source of capital that you can access at any time up to a certain amount agreed upon by you and the bank. Usually, there is no collateral required to get approved, and it’s an ideal tool for businesses that are at least 2 years old.

A business line of credit is a financing tool offered by most business banks. In a nutshell it’s a source of capital that you can access at any time up to a certain amount agreed upon by you and the bank. Usually, there is no collateral required to get approved, and it’s an ideal tool for businesses that are at least 2 years old.

A business line of credit is typically revolving like a credit card and it has no fixed payment terms and is based on an adjustable market based interest rate. Some have a feature of only requiring monthly interest only payments to be made in order to keep the payments small while your business grows. In most cases you can elect to make the full monthly payment of both the principle and interest when you want to and can pay the full balance at any time without penalty prior to the maturity date.

The amount your business is able to receive from a business line of credit will depend on your business past gross annual revenues and projected annual cash flow.

HOT Tip: Most banks will not require business tax returns and profit and loss statements when you keep your credit line of request below $50k.

A good test to see if your business will qualify is to examine your business bank rating to determine if there has been a sufficient average daily balance to adequately support the line of credit repayment. Typically a low 5 bank rating can grant you an approval so be sure to establish a good rating prior to applying.

Here’s what you need to apply for a business line of credit

Business Information

•Business name

•Business address (physical address, no P.O. Boxes)

•Business phone number

•Business fax number

•Business Taxpayer Identification Number(s) (TIN) or Social Security Number(s) (SSN)

•Business Duns Number

•Date the business was established

•Ownership type

•Number of owners

•Gross Annual revenue or sales

•Business banking account number(s) and balance(s)

Business Owner Information

•Name

•Home address

•Home phone number

•Social Security Number(s)

•Country of Citizenship if not United States

•Date of Birth

•Percentage of ownership

•Annual household income

•Personal savings and/or checking account number(s) and balance(s)

Contact Information

•Primary contact (must be an owner of the business)

•Primary contact phone number

•Primary contact email address

One of my preferred banks for business lines of credit is Wells Fargo.

Other banks for business lines of credit that I recommend are:

For a complete list of our preferred lenders join my business credit community today!

Remember – Abundance is not something we acquire. It is something we tune into. ~ Wayne Dyer

To Your Success!

Marco Carbajo

About the Author

Marco Carbajo is a business credit specialist, author, speaker, and founder of http://www.startbusinesscredit.com . Want to learn more about how to build business credit and obtain unlimited financing for your business? Claim Marco’s popular FREE business credit seminar ($597 Value), available by simply submitting your email below =>

Top 10 Business Credit Building Mistakes

Business Credit Building

While many small business owners realize the benefits of starting business credit there are many mistakes that are made in the business credit building process. I felt that compiling a list of the most common mistakes I’ve seen throughout the industry can serve as a helpful guide to you. Here they are…

Choosing the wrong entity structure

Selecting the right entity structure for your business is the most important step you can make. Not just from a business credit standpoint but also from a tax and asset protection standpoint as well. In addition there are state filing fees, franchise fees, licenses, resident agent service and a host of other important factors to consider.

Selecting the wrong SIC code

There are certain codes that the business credit bureaus and lenders tend to stay away from. These industries include real estate investing, car sales, adult entertainment, travel, lending, restaurants, and dry cleaners. When you classify your business be sure to stay away from these classifications.

Selecting the wrong NAICS code

If you plan on investing in real estate then you will want to make sure that the company you build credit on is not “real estate investing”. Most banks will automatically turn you down because this is a high risk category. You still will be able to invest in real estate but you may have to set up a business that does business development, business consulting, marketing & advertising, training and development, etc. and then operate your real estate investments from a separate division or company that does something else.

Using a home or cell phone number as a business phone number

There’s nothing wrong with using these phone numbers but when it comes to business credit building it does matter. Your number has to be listed in the 411 national directories and cell phones and VOIP as well as call forwarding numbers do not work.

Having inconsistent information on business documents

When you start business credit you must pay close attention to details. The information used to open your credit file must match the information you use on applications, documents, and filings.

Applying for credit with the wrong vendors

There are 500,000 vendors in the U.S. that extend credit to businesses but less than 6,000 report to the business credit bureaus. Too many make the mistake of believing that simply doing business with a vendor will result in establishing business credit. Not true!

Applying for credit with vendors that report slow

There are vendors who do report your payment history but only on a quarterly or even yearly basis. Time is of the essence so you have to make sure the vendor you apply with also reports to the business credit bureaus on a monthly basis!

Applying for personal credit cards disguised as business credit cards

Pay special attention to what a credit card application requires and what the terms and conditions are. A credit card that reports only to your personal credit is not a true business credit card

Applying for business credit cards that do not report to the business credit bureaus

There are over 500 business credit cards available in the marketplace but less than 70 report your payment history to the business credit bureaus.

Not establishing an effective bank rating

A minimum of a low 5 bank rating is a must if you plan to apply for a line of credit or loan. You can achieve a low 5 rating with a $10k balance in your account.

To access a complete step by step business credit building system with insider secrets, premium vendors, leasing companies, business credit cards, and lenders that report to all the major business credit bureaus become a member of my Business Credit Insider’s Circle. Submit your name and email below for details and receive a free audio seminar ($597 value) =>

To Your Success!

Marco Carbajo

About the Author

Marco Carbajo is a business credit specialist, author, speaker, and founder of the Business Credit Insider’s Circle. He is a weekly columnist for Dun & Bradstreet Small Business Solutions, a corporate credit blogger for All Business & American Express Small Business and author of “Eight Steps to Ultimate Business Credit” and “How to Build Business Credit with No Personal Guarantee.” His articles and blogs have also been featured in Business Week, The Washington Post, The San Francisco Tribune, Scotsman Guide, Alltop, Entrepreneur Connect, and Active Rain.

Top 4 Reasons Not to Use Personal Credit for Business

Statistics show that over 65% off all small businesses use credit cards on a regular basis; but the problem is less than half of those credit cards are actually in the business name. The others continue to use the owner’s personal credit cards for business transactions.

Statistics show that over 65% off all small businesses use credit cards on a regular basis; but the problem is less than half of those credit cards are actually in the business name. The others continue to use the owner’s personal credit cards for business transactions.

Using your personal credit, also known as you’re “Consumer Credit Profile,” instead of establishing Business Credit is a bad idea on many fronts.

Here are my ‘Top 4 Reasons Why You Should Not Use Personal Credit for Business.’

Reason 1

It impacts your personal debt to credit limit ratios, credit scores, and personal finance capacity for you and your family.

This reason alone has caused severe personal credit damage and liability to small business owners across the country who have lost their businesses due to the recession and have used personal credit and personal guarantees for all their business financing. Just ask Kirk Brown, owner of Buck’s Shoes in Fremont, who knows firsthand what using personal credit for business can do.

When you properly separate your personal credit from business credit the debt you accumulate for your business should only report to your business credit file not your personal credit file. More importantly you protect you and your family from personal liability when you get approved solely on your businesses’ credit file.

Reason 2

When you use your personal credit for the benefit or operation of the company it can lead to an “alter-ego” decision by regulatory or a financial organization, and a piercing of the corporate veil.

This would directly endanger the owner’s personal assets and make the owner or owners directly liable for the penalties or repayment of any debts incurred by the business or corporation.

It’s always a good idea to build business credit rather than abandon it through the co-mingling of funds–and this includes the “co-mingling” of credit profiles.

Many entrepreneurs believe that a corporation protects them because corporations are viewed as separate legal entities but you can jeopardize that protection when you use personal credit for the benefit or operation of your corporation!

Reason 3

Another disadvantage of using your personal credit in place of proper business credit is the fact that the use of personal credit for the operation of a company can make your company appear improperly funded or operated, or may incorrectly establish that your business credit is unstable, unreliable, or overextended.

Reason 4

Last but not least what might be perfectly normal and acceptable for a business credit profile, such as submitting multiple applications for business credit, can have a serious negative impact on personal credit because of what’s called excessive inquiries.

Solution:

Start building business credit for your corporation separate from your personal credit and improve your company’s image, protect you and your family’s assets, credit capacity, and personal liability.

Remember – To be prepared is half the victory. ~ Miguel De Cervantes

Marco Carbajo

About the Author

Marco Carbajo is a business credit specialist, author, speaker, and founder of the National Entrepreneur Club. Click here to visit his blog and signup free to get strategies, resources, and response-boosting tips with blog updates, news, and more! To start building business credit join his business credit community today and Click Here.