After presenting to REIA of Macomb last week it was clear to me that building business credit was a HOT topic for real estate investors. It was interesting to find that small business owners and real estate investors have similiar questions when it comes to business credit.

After presenting to REIA of Macomb last week it was clear to me that building business credit was a HOT topic for real estate investors. It was interesting to find that small business owners and real estate investors have similiar questions when it comes to business credit.

As a result of the economic downturn many find themselves being faced with less than perfect credit. While credit repair companies are springing up all over the country there are few like United Credit that can truly deliver.

But in the meantime can you start building business credit with bad personal credit?

Absolutely!

There are vendors, suppliers, leasing companies, and even cash credit issuers that will extend credit to your business solely based on your businesses credit rating. In order for you to obtain cash credit without a personal guarantee first requires you to start establishing strong business credit with vendors & suppliers.

The key is identifying which vendors & suppliers offer the following:

-

Credit with no personal credit checks

-

Credit with no personal guarantee

-

Credit for start ups (great for new entities)

-

Monthly payment reporting to business credit bureaus

If this part leaves you scratching your head don’t worry we have all this work already done for you if you’re interested. As long as you understand the fact that cash credit without a personal guarantee can only happen once you have established a strong business credit profile.

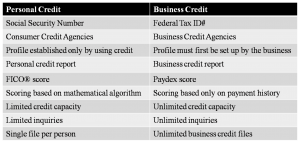

Here’s a quick comparison on personal credit vs. business credit.

As you can see there are HUGE differences and the one in particular that should get you really excited is the unlimited amount of business credit files you can establish!

For a complete list of our preferred business credit sources join my business credit community today!

Remember – Abundance is not something we acquire. It is something we tune into. ~ Wayne Dyer

To Your Success!

Marco Carbajo

About the Author

Marco Carbajo is a business credit specialist, author, speaker, and founder of http://www.startbusinesscredit.com . Want to learn more about how to build business credit and obtain unlimited financing for your business? Claim Marco’s popular FREE business credit seminar ($597 Value), available by simply submitting your email below =>

Statistics show that over 65% off all small businesses use credit cards on a regular basis; but the problem is less than half of those credit cards are actually in the business name. The others continue to use the owner’s personal credit cards for business transactions.

Statistics show that over 65% off all small businesses use credit cards on a regular basis; but the problem is less than half of those credit cards are actually in the business name. The others continue to use the owner’s personal credit cards for business transactions. Lending institutions want to lend money because it’s the way they make money. However, they only want to lend money to a borrower who is able to repay the loan on time and in full.

Lending institutions want to lend money because it’s the way they make money. However, they only want to lend money to a borrower who is able to repay the loan on time and in full.