Vendor credit lines commonly known as “trade credit” is the largest use of capital from business to business and remains the #1 alternative to personal and small business loans. The SBA even reports that vendor credit is the single largest source of small business lending in America today. It also happens to be the initial foundation for businesses to start building business credit.

Vendor credit lines commonly known as “trade credit” is the largest use of capital from business to business and remains the #1 alternative to personal and small business loans. The SBA even reports that vendor credit is the single largest source of small business lending in America today. It also happens to be the initial foundation for businesses to start building business credit.

So what is vendor credit?

Vendor credit is when a company, like an office equipment supplier, allows your business to purchase products and pay for them at a later date. Typically the terms range from Net 15, Net 30, Net 60, Net 90, or even Net 120 payment terms. These vendor credit lines work like a charge card meaning that the balance must be paid in full on or prior to the due date.

The primary benefit to using vendor credit lines is that it will provide your business with thousands of dollars in products and services it needs up front while allowing your business to defer the payments for later. This helps you conserve cash flow for more critical short term expenditures your business may have. The flexible payment terms also allows your business plenty of time to pay the invoice when it comes due.

A secondary benefit is vendors report your positive payment experience to the business credit bureaus. The more vendors you establish credit lines and payment experience with the stronger the business credit profile you will build. This alone can positively impact the size of the credit limit recommendation for your business which is determined by the business credit bureaus and publicly disclosed on your business credit file.

However, one of the biggest mistakes made by small business owners is assuming that every vendor reports their payment history to the business credit bureaus. Currently there are over 500,000 vendors who extend lines of credit to businesses but less than 6,000 report your payment experience to the business credit bureaus.

So when you start to build your business credit file be sure to select vendors that report. You can verify this by inquiring with a vendor that you plan to apply with. Be sure to ask what business credit agency they report to and how often they report.

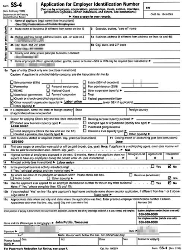

One of my favorite aspects to vendor credit lines is the minimal qualifications required for approval. In many cases an application only requires your business contact information, Federal Tax ID#, Dun & Bradstreet#, authorized name and signature and not your social security number or personal guarantee.

The specific vendors requesting only this information will pull a business credit report to base their approval which makes obtaining vendor credit lines much easier and more convenient compared to credit cards or loans. A prime example of one of these types of vendors is a company called Quill. Quill sells office supplies, cleaning supplies, packing and shipping supplies, school supplies, printing supplies, and more. From filing and storage to hand held computers, Quill has a wide range of discounted top name brand products.

Quill offers a net 30 account and reports to Dun and Bradstreet. Best of all they report your payment history every 30 days. For small orders you can get approved if your business has a listing on the 411 directories and a working website. New businesses can start out with smaller limits that will increase when you pay on time every month.

As you can see vendor credit lines provide your business a way to build a strong business credit file while avoiding the use of your personal credit and guarantee.

*Don’t want to bother doing all this research to find what vendors report to the business credit bureaus? Well, the good news is that I have compiled a list of vendors that are actively reporting to the business credit bureaus and more specifically which ones they report to! To receive this and many other secret business information join my Business Credit Insider’s Circle!

To Your Success!

Marco Carbajo

About the Author

Marco Carbajo is a business credit specialist, author, speaker, and founder of the Business Credit Insider’s Circle. Want to learn more about how to build business credit and obtain unlimited financing for your business? Claim Marco’s popular FREE “Eight Steps To Ultimate Business Credit Without A Personal Guarantee Audio Seminar“($597 Value), available by simply submitting your email below=>

Marco Carbajo is a business credit expert, author, speaker, and founder of the Business Credit Insiders Circle. He is a

Marco Carbajo is a business credit expert, author, speaker, and founder of the Business Credit Insiders Circle. He is a  In the past during good economic times you may have become accustom to using personal credit cards to finance purchases, equipment, and even payments to suppliers or vendors when starting and operating your business.

In the past during good economic times you may have become accustom to using personal credit cards to finance purchases, equipment, and even payments to suppliers or vendors when starting and operating your business.

During the early stages of starting and operating a business, many small business owners have become accustom to using personal credit cards to finance purchases, equipment, and even payments to suppliers or vendors. What’s even more alarming is if you personally guarantee each and every credit card, credit line, or loan for your business then you are putting your personal assets and family at risk!

During the early stages of starting and operating a business, many small business owners have become accustom to using personal credit cards to finance purchases, equipment, and even payments to suppliers or vendors. What’s even more alarming is if you personally guarantee each and every credit card, credit line, or loan for your business then you are putting your personal assets and family at risk!