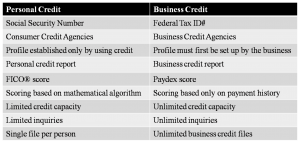

Recently I shared the benefits of building business credit with each of the business credit agencies. Separation of personal and business credit is a must for small business owners in order to eliminate personal liability and protect the integrity of the corporate veil.

Recently I shared the benefits of building business credit with each of the business credit agencies. Separation of personal and business credit is a must for small business owners in order to eliminate personal liability and protect the integrity of the corporate veil.

While this strategy creates a Paydex, Small Business Credit Risk Score, and Intelliscore for your business it’s not the only rating you should pay close attention to.

Your business will also need to establish effective ‘Bank Credit’.

Bank credit is totally separate from building business credit and in no way affects your ability to build strong business credit scores.

“Bank Credit” makes your business more credible in the eyes of lenders. In this post, I want to share with you the ‘3 Main Components of Building Bank Credit’ which are:

- Business Bank Account & History

- Bank Rating Number

- Obtaining Your First Business Bank Loan

So let’s get started!

Business Bank Account

The first step in establishing positive bank credit is to make sure that your business name and mailing address, as listed on your business bank account, matches exactly how your business name and address appear on any legal paperwork that’s been filed with the State. It must also match exactly with the name and address that appear on your Federal EIN paperwork. If it doesn’t match you’ll have to correct it immediately!

Business Bank History

Most lenders also determine the age of your business by the date you first opened your business bank account and not the date that appears on your Incorporation, LLC, or EIN paperwork. However, in some instances banks may also require 24 months seasoning from the start date of your business as well.

Your business banking history is vital to your ability of being able to secure larger business loans with banks. Lenders will look to see how long that relationship has been established, so once you get your account set-up don’t change banks!

The longer your business banking history, the better the borrowing potential you have.

Bank Rating Number

Your business bank account reflects how you manage your cash flow. Lenders want to know that your business cash flow is capable of handling the business debt and expenses on a consistent basis. Bank accounts with low average daily balances, or that show many NSF returned checks, can get your business loan applications declined right away.

If a loan amount requires a $1,000 month payments then lenders need to see at least a “Low 5” bank rating. Your “Bank Rating” is based on your average daily minimum balance over the last 3 months.

|

Bank Rating |

Account Balance |

|

Bank Rating |

Account Balance |

|

Low 4 |

$1,000 – $3,999 |

|

Low 5 |

$10,000 – $39,999 |

|

Mid 4 |

$4,000 – $6,999 |

|

Mid 5 |

$40,000 – $69,999 |

|

High 4 |

$7,000 – $9,999 |

|

High 5 |

$70,000 – $99,999 |

1. The first factor is your balance rating. This rating is your average minimum balance maintained in your account over a three (3) month period. $10,000 will rate as “Low 5”, $5,000 rates as “Mid 4”, $999 rates as “High 3”, and so on. You need to maintain a minimum “Low 5” bank rating ($10,000) for at least 3 months. Unfortunately, without at least a “low 5” rating, most lenders will assume your business has little ability to repay.

2. The second factor is the bank rating cycle which is three (3) months. You’ll want to have at least a low 5 for the three months prior to applying for larger loans.

3. The third and final factor has to do with how you manage the account. NSF (bounced) checks destroy bank ratings. From this point forward, NSF checks are something you can’t let happen. I would suggest that you add overdraft protection to your account as soon as possible.

Obtaining Your First Business Bank Loan

Getting your first business loan from a bank can seem like an impossible task. The majority of the business loan applications at banks get declined because banks won’t lend to just anybody … or will they?

This one business bank loan strategy provides a powerful boost to building business credit fast. The business bank loan needs to be in the exact name of your company. It should be under your Federal EIN and report to the business credit agencies, specifically Equifax Small Business and Corporate Experian.*

So how do you accomplish this? Under this Bank Loan Program you will be securing a business loan with a certificate of deposit (CD) at the bank that is extending the business loan. You’ll make a deposit into a CD account at an SBA preferred lending bank. Then, you receive a business loan for 100% of the value of the CD.

This process works very well and works every time as long as you’re personal credit scores are not in the low 500 range. If your scores are in the low 500’s, it’s best to try smaller business banks and talk to an individual banker first.

The Benefits of a Secured Bank Loan

- It will appear on your business credit report just like any other loan.

- There will be no note in the file, or on credit reports, that show it as “secured”.

- It will make your business credit report stand out to other lenders and creditors who obviously know how difficult it is to get a business bank loan.

If you’re personal credit is a large issue and you just can’t find a business bank to do the CD program for you … don’t worry. You can still build your business credit without the bank loan; the bank loan just makes it faster.

*N.E.C. members are provided access to our list of banks who have done the CD-Secured Business Loan program

Remember – The secret of business is to know something that nobody else knows. ~ Aristotle Onassis

Marco Carbajo

About the Author

Marco Carbajo is a business credit specialist, author, speaker, and founder of http://www.startbusinesscredit.com . Want to learn more about how to build business credit and obtain unlimited financing for your business? Claim Marco’s popular FREE business credit seminar ($597 Value), available by simply submitting your email below =>

After presenting to REIA of Macomb last week it was clear to me that building business credit was a HOT topic for real estate investors. It was interesting to find that small business owners and real estate investors have similiar questions when it comes to business credit.

After presenting to REIA of Macomb last week it was clear to me that building business credit was a HOT topic for real estate investors. It was interesting to find that small business owners and real estate investors have similiar questions when it comes to business credit.

A business line of credit is a financing tool offered by most business banks. In a nutshell it’s a source of capital that you can access at any time up to a certain amount agreed upon by you and the bank. Usually, there is no collateral required to get approved, and it’s an ideal tool for businesses that are at least 2 years old.

A business line of credit is a financing tool offered by most business banks. In a nutshell it’s a source of capital that you can access at any time up to a certain amount agreed upon by you and the bank. Usually, there is no collateral required to get approved, and it’s an ideal tool for businesses that are at least 2 years old. Statistics show that over 65% off all small businesses use credit cards on a regular basis; but the problem is less than half of those credit cards are actually in the business name. The others continue to use the owner’s personal credit cards for business transactions.

Statistics show that over 65% off all small businesses use credit cards on a regular basis; but the problem is less than half of those credit cards are actually in the business name. The others continue to use the owner’s personal credit cards for business transactions.