Many business owners across the country have experienced the cold shoulder from their banks and seen their credit lines reduced as a result of rising losses, the credit crisis, and economic uncertainty. Are credit cards for small business on the rise or decline?

While major credit card issuers like Advanta have left the business earlier this year it’s refreshing to see that banks like J.P. Morgan Chase card services announced today that it plans to launch four more credit cards specifically targeted at small-business owners! Among them will be a credit card that requires the cardholder to pay their balance in full each month similiar to Amex’s card.

Richard Quigley, president of Chase Business Cards said “It’s really going to be small businesses that are going to help pull the U.S. out of the recession.” Now we have all known this from the very beginning of this financial mess but it’s about time that these national banks realize it and do something about it.

Even though this is good news for small business owners there are some that see this as a strategy that banks are pushing simply because business credit cards aren’t covered under the new regulations that restrict issuers from raising rates and fees on consumer credit cards. Whatever the reason is I believe that the more options small business owners have when it comes to credit cards the better. Hopefully Chase will roll out some true business credit cards but I do like that they are positioning themselves to compete with American Express.

Competition is a good thing and when it comes to small business credit cards the winner is the small business owner! For example, Chase’s Ink Bold card—the first charge card offered by a Visa or MasterCard issuer—is aimed at business owners who want to avoid paying interest charges. It comes with a variable credit line that automatically adjusts to the business owner’s spending patterns. Annual fees are $95, but the first year’s fee is waived.

Here are some other aspects to Chase’s new small business credit cards compared to Amex.

Chase’s Four New Small Business Credit Cards – Ink Bold, Ink, Ink Plus and Ink Cash

*They are accepted at twice as many locations worldwide as American Express

* InkSM Bold — Chase’s first pay-in-full charge card with no interest

charges

– Ink Bold has no annual fee for the first year and $95 thereafter

*InkSM — Developed for small business owners seeking business-sized

credit limits, flexible payment options and online expense management

tools with the ability to earn rewards from business purchases with no

limit on how many points may be earned and the points do not expire.

-Ink has no annual fee.

*InkSM Plus — The solution for small business owners seeking

business-sized credit limits, flexible payment options, online expense

management tools and the ability to earn rewards from business purchases

including extra travel benefits with no limit on how many points may be

earned and the points do not expire. Rewards points also are worth 25

percent more when redeemed for air travel through Ultimate RewardsSM and

cardmembers can earn an annual spend bonus of up to 25,000 points.

-Ink Plus has no annual fee for the first year and $60 thereafter.

*InkSM Cash — Designed for small business owners seeking unlimited cash

back and accelerated earnings on everyday business purchases: dining,

fuel, home improvement and office supplies. Ink Cash provides

business-sized credit limits, flexible payment options and online

expense management tools.

-Ink Cash has no annual fee.

Ouch! I’m sure Amex doesn’t like to see this!

If you like to stay informed and here about the latest news regarding business credit be sure to subscribe to my blog.

Better yet CLICK HERE to become a business credit member and discover what business credit can do for you!

By the way, what would you like to see more of on this blog? Any questions? Let me know 🙂

To Your Success!

Marco Carbajo

About the Author

Marco Carbajo is a business credit specialist, author, speaker, and founder of http://www.startbusinesscredit.com . Want to learn more about how to build business credit and obtain unlimited financing for your business? Claim Marco’s popular FREE business credit seminar ($597 Value), available by simply submitting your email below To Your Success! =>

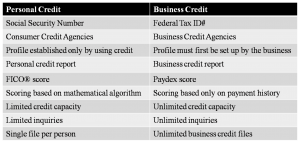

During the early stages of starting and operating a business, many small business owners have become accustom to using personal credit cards to finance purchases, equipment, and even payments to suppliers or vendors. What’s even more alarming is if you personally guarantee each and every credit card, credit line, or loan for your business then you are putting your personal assets and family at risk!

During the early stages of starting and operating a business, many small business owners have become accustom to using personal credit cards to finance purchases, equipment, and even payments to suppliers or vendors. What’s even more alarming is if you personally guarantee each and every credit card, credit line, or loan for your business then you are putting your personal assets and family at risk! After presenting to REIA of Macomb last week it was clear to me that building business credit was a HOT topic for real estate investors. It was interesting to find that small business owners and real estate investors have similiar questions when it comes to business credit.

After presenting to REIA of Macomb last week it was clear to me that building business credit was a HOT topic for real estate investors. It was interesting to find that small business owners and real estate investors have similiar questions when it comes to business credit.

A business line of credit is a financing tool offered by most business banks. In a nutshell it’s a source of capital that you can access at any time up to a certain amount agreed upon by you and the bank. Usually, there is no collateral required to get approved, and it’s an ideal tool for businesses that are at least 2 years old.

A business line of credit is a financing tool offered by most business banks. In a nutshell it’s a source of capital that you can access at any time up to a certain amount agreed upon by you and the bank. Usually, there is no collateral required to get approved, and it’s an ideal tool for businesses that are at least 2 years old.