One of my friends recently asked me whether or not he can build corporate credit for his home based business. After asking a few simple questions there was really only one obstacle that was preventing him from starting which was the legal structure of the sole proprietorship that he chose for his company.

One of my friends recently asked me whether or not he can build corporate credit for his home based business. After asking a few simple questions there was really only one obstacle that was preventing him from starting which was the legal structure of the sole proprietorship that he chose for his company.

Unfortunately, this happens to be the most common choice among home based businesses. Normally you don’t pay anything to start a sole proprietorship. Of course you don’t get anything, either.

Unless you count the following as valuable business assets:

* Lots of personal liability

* No protection from your business creditors

* An increased risk of being audited

* Problems with valuation for a subsequent sale of the business

The reason for this lack of protection is because a sole proprietorship is not considered a separate legal structure. Instead, it is considered a personal extension of you and because this business types is considered a personal extension of you, you don’t have any protection from it.

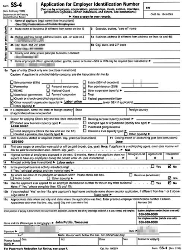

In addition, you can’t establish corporate credit separate from your personal credit with a sole proprietorship. In order to build company credit you will need to first incorporate your home based business and next obtain an employee identification number (EIN).

This step by far is the most important because it’s the foundation for what you will build business credit upon. Not to mention all the other important areas that entity selection affects such as taxes, liability and asset protection.

Once you incorporate your business and have obtained an employee identification number you will then need to complete the standard corporate conformity guidelines that creditors expect your business to complete. There are over twenty specific tasks that I review with our members prior to setting up their business credit file and applying for vendor credit lines to build their corporate credit.

Now if you’re wondering why your home based business would need this credit information first ask yourself the following questions:

Do I use my personal credit cards to pay for my home based business expenses?

Do I purchase goods and services from other businesses using my personal credit in order to operate and grow my home based business?

Do the credit card charges I incur for my home based business show up on my personal credit reports?

When you build business credit you have the unique opportunity to obtain business credit cards with no personal guarantee. Best of all when you use these cards for your home based business expenses they don’t affect your personal credit reports!

Some other benefits include:

- Business credit cards have much higher limits than personal credit cards.

- You can build companycredit even if you have bad personal credit

- Reduce your tax burden and improve accounting

If you’ve been doing business up to now without a business structure, both the IRS and your state government defaults your business into a sole proprietorship.

And that means you’re exposed.

Now is the time to select the proper business structure for your home based business if you want to establish corporate credit and you want to protect yourself from personal liabilities.

To access corporate credit insider secrets, premium vendors, leasing companies, business credit cards, and lenders that report to all the major business credit bureaus become a member of my Business Credit Insider’s Circle. Submit your name and email below for details and receive a free audio seminar ($597 value) =>

Marco Carbajo is a business credit specialist, author, speaker, and founder of the Business Credit Insiders Circle. He is a weekly columnist for Dun & Bradstreet Small Business Solutions, a business credit blogger for All Business & American Express Small Business and author of “Eight Steps to Ultimate Business Credit” and “How to Build Business Credit with No Personal Guarantee.” His articles and blogs have also been featured in Business Week, The Washington Post, The San Francisco Tribune, Scotsman Guide, Alltop, Entrepreneur Connect, and Active Rain.

Marco Carbajo is a business credit expert, author, speaker, and founder of the Business Credit Insiders Circle. He is a

Marco Carbajo is a business credit expert, author, speaker, and founder of the Business Credit Insiders Circle. He is a  I was excited to write this particular post because there is such a tremendous lack of awareness in the entrepreneur and small business community surrounding the business credit industry.

I was excited to write this particular post because there is such a tremendous lack of awareness in the entrepreneur and small business community surrounding the business credit industry. In the past during good economic times you may have become accustom to using personal credit cards to finance purchases, equipment, and even payments to suppliers or vendors when starting and operating your business.

In the past during good economic times you may have become accustom to using personal credit cards to finance purchases, equipment, and even payments to suppliers or vendors when starting and operating your business. I felt inspired to write this post after receiving so many questions about business credit and how you go about getting approved for cash credit lines despite the current credit crunch in the economy.

I felt inspired to write this post after receiving so many questions about business credit and how you go about getting approved for cash credit lines despite the current credit crunch in the economy.