Score Based Business Line of Credit

I’m excited about today’s blog post because we are going to show you how to get an unsecured business line of credit with a soft pull and no personal guarantee.

This is an actual line of credit that you can acquire that not only builds your business credit but also protects your personal credit too.

So, before we get into details on applying, let’s talk about what a score based business line of credit is.

This credit line provides two ways for you to access funds up to your approved credit limit.

Draw Cash Online – You can draw cash from your business line of credit directly to your business bank account via your online account portal. Once logged in you can select how much funds you want deposited into your account up to your credit available.

The benefit of this function is no cash advance APR. With standard business credit cards, you are limited to how much cash you can advance. Also, if you do there is a cash advance APR that is triggered on the amount advanced which is typically above 20%.

Business Credit Card – A World Business MasterCard® is issued to your company which can be used for purchases up to your credit limit.

Now, once you use your credit line there are several options to repay your outstanding balance. You can either pay the minimum monthly payment, pay more than the minimum monthly payment or pay the balance in full.

The annual interest rate ranges from 9.9% – 19.99%. The rate issued to your company will depend on how strong your personal Experian FICO® score is since this is based on your score alone.

Here is a quick overview of the Score Based Business Line of Credit

- Up to $10k based on credit score only (Stage 1)

- Soft pull only (Experian FICO®)

- No Personal Guarantee

- 301 – 800+ credit scores are approved

- Reports only to Dun & Bradstreet

- Builds your business credit

- Can increase credit limit up to $100k (Stage 2)?

- For startups or existing businesses

- Draw funds directly to your bank account or use your World Business MasterCard®

Who qualifies for a score-based business line of credit?

What separates this credit line from all others is the ease of approval. There are no big hurdles to overcome or revenue requirements whatsoever. It’s based on your Experian credit score which must be at least 301 or higher.

Think about that, you can get an unsecured business line of credit with no personal guarantee, reports only to the business credit bureaus, with a credit score as low as 301.

Now, what is important is your business must have a need for a merchant account or already be using one. If you don’t have a merchant account, we set one up for you. So, if you have a business that does not take payments from customers via credit cards then this line of credit would not work for you.

For example, if you are a real estate investor and all you do for your business is invest in real estate than this would not work for you since you don’t accept payments from customers.

What is a merchant account?

A merchant account is a type of bank account that allows your business to accept payments in several ways, typically debit or credit cards. A merchant account is established under an agreement between an acceptor and a merchant acquiring bank for the settlement of payment card transactions.

With a Merchant Account you can accept payments via Visa & MasterCard® over the phone, over the internet or in person.

Why is a merchant ID required?

The reason a merchant ID is required is because the line of credit is linked to your merchant account. This minimizes risk for the card issuer. Now, if you already have a merchant ID that’s great. That means we can apply for this line of credit for you right away using your existing merchant ID.

If you don’t have a merchant account then we will set one up for you first, and then apply for your line of credit.

This is all included in our process, by the end you’ll be able to accept payments from customers via credit cards and have a business line of credit issued to your company.

Now one important thing I want to cover is the confusion on what an actual merchant account is. Payment platform such as Paypal, Square, Stripe, etc. do not set you up with a merchant account. These are third-party payment processors which allow you to bypass having a merchant account because you are using their platforms.

So, let’s say you’re using Stripe to run your business and receive payments from customers. If you want to apply for the score-based line of credit then we will need to set you up with your own merchant account since Stripe does not issue you a merchant ID.

This doesn’t mean you have to stop using Stripe, but we encourage you to start using your own merchant account because your line of credit can increase over time.

The good news is whatever way you accept payments now using Stripe or any other third-party processor you can accept with your own merchant account.

Whether you use a virtual terminal, Mobile POS, card reader or other POS system you can use with your own merchant account.

Score Based Business Line of Credit Requirements

- Must have a minimum Experian FICO® credit score of 301+

- Startup or existing business

- All entity types accepted – DBA / Sole Proprietors, LLC, Corporations, etc.

- Must have a real use for a merchant account or already have one in use – (accept payments from customers via Visa & MasterCard®)

- If you don’t have a Merchant account, we set one up for you.

- If you have an existing Merchant account it gets linked to your BLOC. You must have a real Merchant ID for it to link.

Bottom Line – If you already accept credit card payments online or offline from customers or have a need to than you qualify.

This Business Line of Credit is linked to a merchant account. (Required)

Option 1: If you have an existing merchant ID you can link your existing merchant account to the business line of credit.

Option 2: If you don’t have an existing merchant account then we will set one up for you. Once your merchant ID is issued it will then be linked to your business line of credit.

There are several restricted industries to this program:

- Adult

- Gaming

- Marijuana

Score Based Business Line of Credit Overview

Up to $10,000 Business Line of Credit – based on personal Experian FICO® score only

During the initial approval for your line of credit it will be strictly based on your Experian FICO credit score. Once your credit limit is issued you have the opportunity to request a credit limit increase in stage 2.

Stage 1 Approval Process

- Soft Pull – No impact to your personal credit

- Credit Scores from 301-800+ are approved

- Initial Credit Limit range from $200 – $10,000

- Receive a World Business MasterCard®

- Actual Line of Credit – Draw Cash (No cash advance fees)

Stage 1 Credit Limit Projections

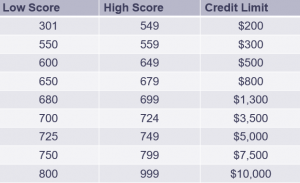

The chart below gives you an indication of the credit limit you’ll receive based on your Experian FICO® credit score.

Stage 2 Business Cash Flow

After the initial business line of credit is issued in Stage 1 you can request a credit limit increase up to $100,000 if you…

Submit business bank statements for review OR submit existing merchant processing statements for review.

Stage 2 Actual Client Example

Client’s Initial Score Based BLOC (Stage 1) was approved for $500 credit limit with credit score of 620. At Stage 2 the client submitted bank statements and the credit limit increased to match the company’s expenses. As a result the initial $500 credit limit was increased to $75,000. (disclosure: client is processing $300k monthly)

Credit Limit Increases Every 3 Months

After your business line of credit is active you have the opportunity to increase your credit limit every three months in 2 different ways:

First, if your credit score improves by 50+ points or if your business revenue is over 2X your current approval. This is a powerful incentive for you since your line of credit will grow as your business does. This also is a benefit that other third party payment platforms you may be currently using do not offer.

What You Need Before You Apply for Score Based Business Line of Credit

- Articles or DBA or Business license

- Driver’s license or other ID (Passport, etc.)

- Voided business check or Bank Statement or Bank letter

- EIN Letter (SS4) or LTR147C or tax return

Apply for the Score Based Business Line of Credit

Step 1 – Go to http://firstbusinessline.com

Step 2 – Complete the Docu-Sign form and upload required docs

Step 3 – After submitting the form you will receive an email confirmation. Processing time is approximately 14-20 days.

Looking for more ways to build your business credit? Become a member of my Business Credit Insiders Circle and gain access to a proven step-by-step business credit building system. A system that provides you access to vendor lines of credit, fleet cards, business credit cards with and without a PG, funding sources and lenders that report to all the major business credit bureaus. Submit your name and email below for details and receive a free business credit building audio seminar ($497 value) =>

To Your Success in Business and in Life!

Did This Blog Help You? If so, I would greatly appreciate if you like and shared this on Facebook and Twitter.

About the author

Marco Carbajo is a business credit expert, author, speaker, and founder of the Business Credit Insiders Circle. He is a business credit blogger for Dun and Bradstreet Credibility Corp, the SBA.gov Community, Business.com, About.com and All Business.com. His articles and blog; Business Credit Blogger.com, have been featured in ‘Fox Small Business’,’American Express Small Business’, ‘Business Week’, ‘The Washington Post’, ‘The New York Times’, ‘The San Francisco Tribune’,‘Alltop’, and ‘Entrepreneur Connect’.

Marco Carbajo is a business credit expert, author, speaker, and founder of the Business Credit Insiders Circle. He is a business credit blogger for Dun and Bradstreet Credibility Corp, the SBA.gov Community, Business.com, About.com and All Business.com. His articles and blog; Business Credit Blogger.com, have been featured in ‘Fox Small Business’,’American Express Small Business’, ‘Business Week’, ‘The Washington Post’, ‘The New York Times’, ‘The San Francisco Tribune’,‘Alltop’, and ‘Entrepreneur Connect’.