What Are The Advantages?

Did you know 30% of your credit score is determined by your outstanding debt?

Your credit usage ratio refers to how much of your available credit you use on a monthly basis. It’s defined as your total credit card balances divided by your credit card limits.

The higher the credit usage ratio (also known as credit card utilization), the lower your credit score. According to Rod Griffin, director of public education for Experian, “A person who is charging to the limit on their credit cards is far more likely to suddenly have repayment problems than a person who uses their credit cards sparingly.

So the key is to leverage your credit usage ratio to your advantage by keeping your overall and individual revolving credit card balances below 30% of the credit limits.

The credit scoring model will evaluate your credit usage ratio into four categories:

- The total amount you owe to all of your creditors

- How many accounts you have with balances – too many accounts could indicate a higher credit risk of default if you can’t handle the payments.

- How much of the credit limit you are using on revolving accounts, under 30% – 35% of the available credit limit is ideal.

- Balance on installment loans – low balances reflect a positive payment history.

Now that you know how and why a high credit usage ratio can hurt your scores, why not use this information to your advantage?

How Can You Lower Your Credit Usage Ratio?

There are three easy ways to lower your credit usage ratio. First, pay more than the minimum payment each month to pay down your debt. Even if its a small amount the additional money will add up over time reducing your balance.

Secondly, if you have more than one credit card it’s best to have various cards with low credit usage ratios rather than one card with a high credit usage ratio.

For example, if you have three credit cards and one is maxed out at $5k while the other two have $0 balances and $5k credit limits than transfer $3,500 from the one card putting $1,750 on one card and $1,750 on the other.

The Result- You would now have three credit cards with individual credit usage ratios slightly above 30% rather than one card with a 100% credit usage ratio.

Finally, if you have good payment history try to increase your available credit limits with existing cards. For example, let’s say you have a balance of $4,500 and your credit limit is $5,000. That’s a whopping 90% credit usage ratio!

If your credit card issuer increases your credit limit to $9,000 it would automatically improve your credit usage ratio and bring it down to 50%!

If you are in the early stages of rebuilding your credit and you just obtained one or two secured credit cards from Step 2 remember the same principle applies.

Use your secured credit cards each month and pay your balance on or ahead of the due date. Keep any revolving debt below 30% and increase your limits when possible. With a secured card it’s as simple as adding additional funds since your deposit equals your credit limit.

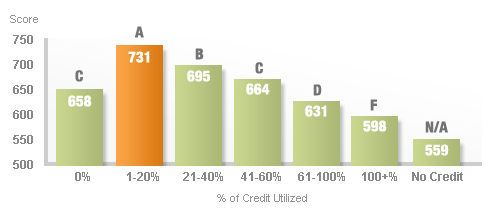

Remember, you do not have to carry a balance every month to show a credit usage ratio, but as you can see in the chart below maintaining a 1% – 20% credit usage ratio is what people with the highest credit scores in the country fall under.

On a final note, if you max out a credit card but pay off the balance in full by the statement due date you avoid all those interest changes but you can still negatively impact your credit usage ratio.

The reason is credit card issuers have a reporting date with the credit reporting agency they subscribe to and share data with. This reporting date is typically not the same date as your statement due date.

If your outstanding balance is high on the date your credit card issuer reports it, you’ll have a high credit usage ratio. So to avoid making this costly mistake you can contact your credit card issuer and inquire about their reporting date.

If they will not supply that information to you then an alternative option is to spread your charges over two or more cards to keep your charges below the 30% ratio.

Call Today for a FREE No Obligation Credit Consultation:

1-517-518-8847

Stay Tuned for Step 4!

Step 1 Step 2

To your success in credit and life,

Marco Carbajo